MONDAY, FEBRUARY 27, 2012

ProtectVEST Generates Major Winter Quarter Price Level Insurance (Hedge) Alerts on American Large Cap Indexes and Gold Metals Market.

Today ProtectVEST by EchoVectorVEST Issued Significant and Major Price Level Insurance Alerts for this Winter Quarter for Both (1) The American Large Cap Stock Indexes and their Positively Correlated ETF's and (2) The Global Gold Metals Market and its Positively Correlated ETF's.

Included are Major Market Indexes and their positively correlated ETFs and Mutual Funds, such as the SPX - SPY, INDU - DIA, Russell 2000 - IWM; and, also included is the Gold Metals Market Indexes (and to an extent other 'gold price attached' metals markets such as the silver and copper markets) and their positively correlated ETF's and Mutual Funds, such as the $GI and the GLD and DGP.

These two major Winter Quarter Price Level Insurance Alerts are for 2012 application, this week and next.

And, for ongoing maintenance and adjustment, as of today, would be set for continuence going potentially well into the end of March.

Insurance coverage (hedges) on exposed portfolios to protect current price level values and gains has been designated as timely.

For more Advanced Active Risk Management Applications and Full Net PortfolioValue Optimization Management Applications, Full Net Short and Full Net Double Short Positioning in both these sectors have also been designated as timely.

Note: Unlike this Major Seasonal Index Price Correction ALERT, other Short-Term Swing-Trading Based Alerts and Motions, and other HFT (High Frequency Trading) Based Alerts and Motions, have also been issued, on a time-specific and or price-specific bases, this year, by ProtectVEST and AdvanceVEST by EchoVectorVEST.

Security-Specific Alerts and Motions, and Instrument-Specific Long, Double Long, Insurance, Short, and Double Short Alerts and Motions, have, additionally, been issued this year also by ProtectVEST and AdvanceVEST by EchoVectorVEST.

According to the ProtectVEST and AdvanceVest by EchoVectorVEST (Divisions of Motion Dynamics and Precision Pivots) Forecast Model and Alert Paradigm and Advanced Risk-Management and Portfolio Price Exposure Protection Methodology and Technology, both this week and next week constitute significant ALERT WEEK PERIODS for the timely application of general Portfolio Price Level Hedging Insurance and Potential Short and Double-Short Positioning Opportunities for market participants in the 'Major Markets (Stock Indexes)' and in the GOLD Metals markets.

These ALERTS are meant to signify FORECASTED PRICE DIRECTIONAL BIAS (periods of derivative velocity weakness) regarding the ProtectVEST OUTLOOK within these specified ALERT markets for Prudent Price Level and Value Level Portfolio Risk Management Optimization.

This 'prudent risk management optimization period' begins immediately, and goes forward into early Spring of 2012 (that is, forecast bias generates an outlook of potential relative market price level trend 'de-strenghening' and potential relative market price level trend weakening into the end of March).

CAUTIONARY NOTE: ACTIVE ALERT MITIGATION FACTOR: Stay Nimble During this Fed Announcement Week.

ProtectVest by EchoVectorVest MDPP

"We're keeping watch for you"

http://hstrial-protectvest.homestead.com/services.html

Further Note: The ProtectVEST Forecast Model and ALERT Paradigm has also generated a further and significant and additional DELTA INCREASE in the general Price Level Risk Reward Ratio for general stock market indexes presently occuring by the end of April.

Posted by EchoVectorVest at 3:45 PM .

ABX: Trader's Edge GuideCharts: ABX: Key Weekly (WEVs) and Daily (DEVs) Cycle EchoVectors and Key Related WEV and DEV Phase Period EchoBackDates (EBDs): 6-Day 5-Minute and 3-Day One-Minute OHLC Perspectives: Real-time WEDNESDAY 9 February 2012 10AM (WEV) and Real-time 2PM (DEV) Snapshots and Heuristics. www.echovectorvest.com

2/15/12

Trader's Edge EasyGuideChart

GLD ETF 90 Day Hourly OHLC

EchoVectorVEST MDPP

Key QEV EchoVectors

2/15/12

GLD ETF and /GC Gold Futures: Trader's Edge EasyGuideCharts: 90 Day Hourly and 2 Hourly OHLC: Key QEV EchoVectors and EBDs: Wednesday 15 Frebruary 2012 www.echovectorvest.com

2/13/12

2/1012

FRIDAY, FEBRUARY 10, 2012

GLD: ALERT RESULTS: POSITION EXPOSURE ADJUSTMENTS: CAPITAL GIANS LOCK:

www.echovectorvest.com

Thursday 9 FEBRUARY 2012 AM Pre-Market Trading

ALERT: GOLD METAL: GLD ETF: /GC GOLD FUTURES:

2/9/12

ABX: Key Weekly (WEVs) and Daily (DEVs) Cycle EchoVectors and Key Related WEV and DEV Phase Period EchoBackDates (EBDs) and EchoBackPricePoints (EBPs): 6-Day 5-Minute and 3-Day One-Minute OHLC Perspectives: Real-time WEDNESDAY 9 February 2012 10AM (WEV) and Real-time 2PM (DEV) Snapshots and Heuristics.

2/9/12

Price Mapping the /GC

CONTEXT

Key Bi-Quarterly Cycle EchoVectors (2QEVs) and Quarterly Cycle EchoVectors (QEVs) and Related Quarterly Period Phase EchoBackDates (EBDs), /GC Gold Futures 15 Months Daily OHLC Perspective

2/10/12

2012 ARCHIVE: SCROLL DOWN FOR ADDITIONAL 2012 BLOGS (charts and analysis) ON GLD ETF AND ABX

POPULAR SELECTIONS FROM THE 2012 ARCHIVE

ABX

GOLD METALS, FUTURES, ETFs, AND MINERS

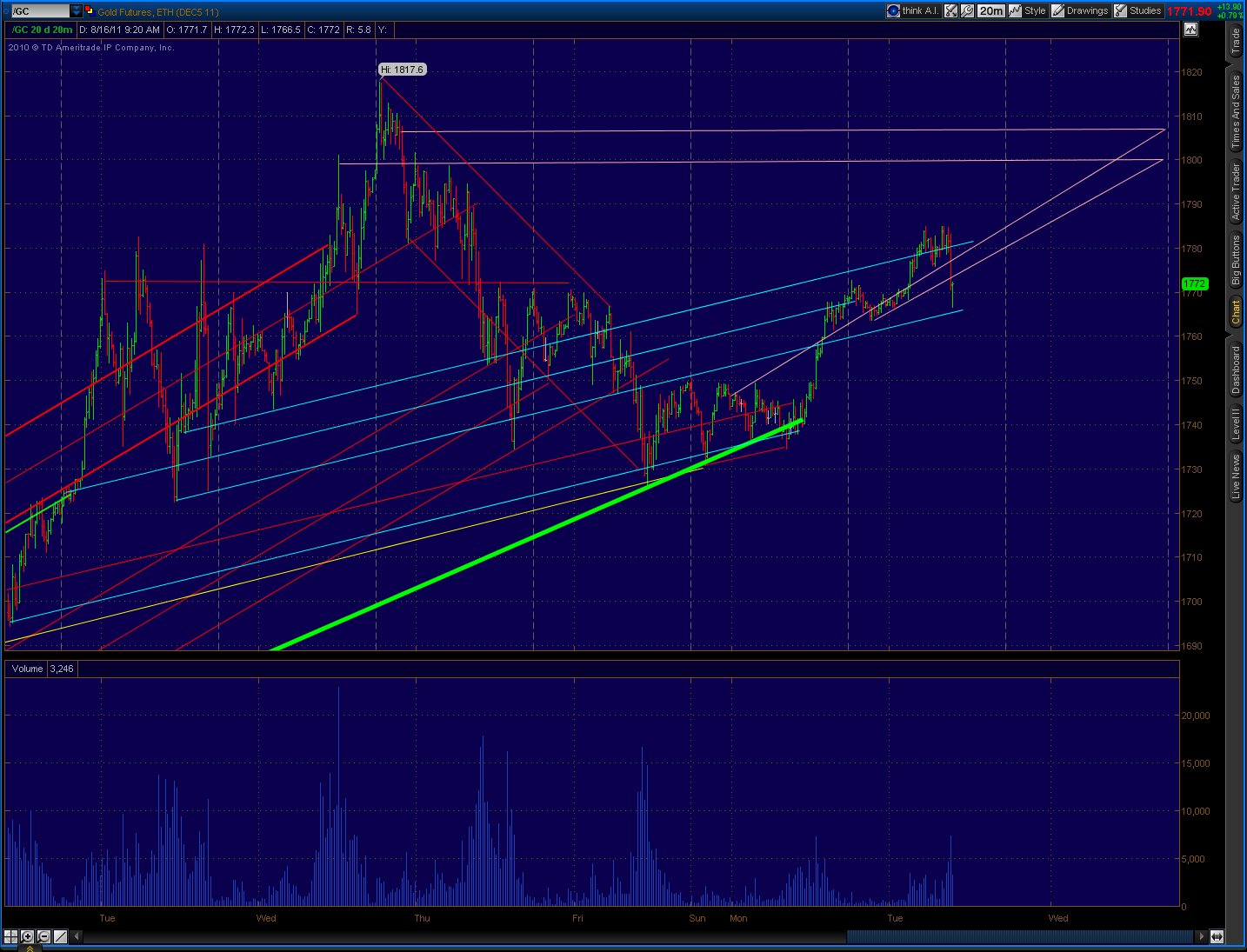

TUES 16 AUG 11 AM EST: Currently Active EasyGuideChart: /GS Gold Futures Basis

WEV in Blue. KEY Support Vector in Green. ST AVEVector GuidePath in ascending purple. Currently extrapolated WEV Key Price/Time Point Echo Targets in horizontal light purple.

___________________________________NotableSample___________________________________

Globally Syndicated Archived EchoVector Analysis Precious Metals ARTICLES

ProtectVest and AdvanceVest by EchoVectorVest, Divisions of Motion Dynamics and Precision Pivots, Bradford Market Research and Analytics

Currently A FREE Educational, Forecast Opinion, and Forecast Methodology and Related Strategies Discussion Resource and Forum

WWW.MOTIONDYNAMICSANDPRECISIONPIVOTS.COM

ADDITIONAL BLOGS ON GLD ETF

AND ABX

MULTI-CHART REFERENCE DISPLAY WITH ILLUSTRATED HIGHLIGHTS: PRICE MAPPING THE /GC

GOLD, GLD, /GC: Key Annual (AEV), Bi-Quarterly (2QEV) and Quarterly Cycle EchoVectors (QEVs), and Key Related Quarterly Period Phase EchoBackDates (EBDs): 15 Month Daily OHLC Perspective: Thursday 9 February 2012 www.echovectorvest.com

Articles Published and Featured In 2013 In

NASDAQ.COM Official Site Of The Nasdaq Stock Market

CNBC ONLINE First In Business Worldwide

MARKETWATCH Stock Market Quotes, Business News, Financial News

MSN MONEY Investing

YAHOO FINANCE Business Finance, Stock Market, Quotes, News

SEEKING ALPHA Stock Market News and Financial News

BULLFAX Market News and Analysis

STREETINSIDER If You're Not Inside You're Outside

BIZWAYS Investment Opportunities And Industry News

FINANCIAL VISUALIZATIONS Financial Research, Analysis, and Visualization

FINANCE ROUNDTABLE Market Forecasts and Finance, UNC Chapel Hill

YAHOO FINANCE CANADA Business News, Real Time Stock Quotes, Investing Tools

NEWS NOW UK Industry, Sector, Commodity, Precious Metal News

THE ECONOMIC TIMES Business News, Personal Finance, Financial News

FINANCE PONG Global Financial And Market News

SEEKING ALPHA JAPAN Overseas Asia

ROYAL METALS GROUP The Trusted Name In Precious Metals

SHARPS PIXLEY NEWS Bullion Brokers London Since 1778

A-MARK PRECIOUS METALS Gold, Silver, Platinum - Charts and Graphs

STERLING INVESTMENT SERVICES Buy Side Research

GOLD NEWS TODAY Current Gold Prices And Precious Metals News

GOLD TREND Intelligent Gold Investing

GOLD PRICE TODAY Gold News

GOLD RATE 24 Gold News

INDONESIAN COMPANY Commodity News

REGATOR Only The Best Blogs

NEWSBLOGGED Latest News, Videos, and Live Videos

YAHOO VOICES General Yahoo Contributors' Network

and many more.

See MDPP's GoldPivots for Direct Hyperlink Buttons

(Gold Script Blue Bottons on Left of GoldPivots Page) for Each of the Above Listed Sites.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

FOR THE MOST RECENT ECHOVECTORVEST MDPP CHARTS AND ANALYSIS ON

GOLD METALS, GOLD FUTURES, AND GOLD ETFS SEE:

MDPP PRECISION PIVOTS Model-Generated

And Analysis

Highlighted With Key Active Focus Interest EchoVectors,

EchoBackDates, EchoBackTimePoints

And Coordinated Focus Interest Opportunity Forecast EchoVectors

Your Technical Edge to Price Perspective and Change in the Gold Market

"We're keeping watch for you!"

Today's EchoVector Pivot Point Chart And Analysis Update: Silver

AUGUST 9 2013

Includes: SLV

This year's dramatic gold and silver price declines are big news. However, since July price lows, some gold and silver analyst are suggesting a price bounce may now be underway, particularly in silver, which at a fundamental level may possess certain additional positives.

Silver is used more broadly than gold for industrial purposes. Silver demand overseas, particularly in Southwest Asia, has recently been reported to be reaching record levels. Silver coin demand in North America is stronger than ever on certain measures. HSBC, a significant bullion bank, sees silver prices remaining in a new and lower trading range this year, but still sees a potential upside target for the precious metal over that is 3 points higher than its current price occurring sometime before year's end. Recent options activity in silver also appears more bullish. Some indications of possible supply growth reductions in silver in the near-term currently exist. And forces inducing the central bank's generally loose monetary policy in the United States, high unemployment level in particular, appear unresolved.

In late August I presented "Today's EchoVector Pivot Point Chart And Analysis: Silver" which also looked at silver's annual price chart from an EchoVector Price Analysis Perspective highlighting occurrences of silver's annual price pattern symmetries' and the possible near-term trading implications of them. Significant symmetries were presented. I focused on the SLV ETF chart as my proxy for silver metals market price action. Today I would like to also provide a very interesting update to that SLV price chart I presented as well.

(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

CLICK HERE TO SEE CHART.

Looking at today's chart update, we can see once again very clearly the significant symmetry that emerged in the key active annual echovector (highlighted in solid red) running to this year's current price low on Thursday June 27 from its corresponding echo-back-date low one year earlier on Thursday June 28, 2012.

Thursday this week we had a gap open in the SLV, with good price extension through lunch time, and a close near the high of its daily trading range.

And very interestingly, we can now also see that the annual echovector to Thursday August 8 from its corresponding annual echo-back-date of Thursday August 9 2012 is a parallel, and that this same echovector momentum and powerful price symmetry coordination is still very much in effect.

This year's green highlighted time-price box which corresponds to last year's coordinate green time-price box (which continued last year until silver's price 'broke out' last August 20), and these boxes symmetry, also remain very much intact, and continue in remarkable coordination.

We can very interestingly see that this year's ascending green echo-price support vector located within this year's green box also served as the gap opening price support level in Thursday's relatively strong price action.

As I mentioned in July's article, analyst may find last year's price action and this year's effective symmetries very suggestive from an echovector pivot point perspective, and for forming their silver price outlook. And the next several week's could prove particularly interesting in this formulation. If a reasonable price echo and its extension in this period of August or September doesn't occur, additional short selling pressure to new price lows could form on a technical basis.

Silver's strong price up-draft last year occurred once prices broke out of the trade box in August after last August's significant 3RD Saturday options expiration date. This strong updraft and positive price extension lasted well into mid-September. These past price movements and patterns may become particularly significant to trader's as we move into this year's corresponding week's, given this year's current active price symmetries and coordinated price momentum currently active at these key time-points and their echovectors.

Thanks for reading. And good luck in your silver investing and trading!

Disclosure: I am long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long SLV. I have a current swing trading position in SLV initially opened Friday August 31 2013. I may be looking to possibly add to my position as this week and month progress.

This article is tagged with: Gold & Precious Metals

Your Technical Edge to Price Perspective and Change in the Gold Market

"We're keeping watch for you!"

See Highlight Exhibit Week Blog: ECHOVECTORVEST.BLOGSPOT.COM: MONDAY, FEBRUARY 27, 2012

_______________________________________________________________________________

PROTECTVEST ACTIVE ADVANCED MANAGEMENT METHODOLOGY

EXHIBIT WEEK FOR GLD ETF

DAILY INTRADAY MOTIONS AND SUMMARY RESULTS FROM ACTIVE METHODOLOGY ALSO INCLUDED

February 13-17, Real-Time Stamp Confirmation:

ProtectVEST by EchoVectorVEST MDPP,

SCROLL TO BOTTOM OF PAGE FOR COMPARISON OF WEEKLY TOTAL GAINS.

COMPARING RESULTS FOR

(1) PROTECTVEST ACTIVE ADVANCED MANAGEMENT TECHNOLOGY APPLIED THROUGHOUT THE EXHIBIT WEEK, AND

(2) PASSIVE BUY AND HOLD INVESTMENT/MANAGEMENT STRATEGY MAINTAINED FOR THE SAME WEEK!

___________________________________________________________________________________________________________________

THE ACTIVE ADVANCED MANAGEMENT TECHNOLOGY GAIN WAS $77,830.89

FOR THE EXHIBIT WEEK!.

THE PASSIVE BUY AND HOLD MANAGEMENT GAIN WAS $59.76

FOR THE WEEK!

ON A $500K PRINCIPAL EMPLOYED BASIS.

See the ProtectVEST Difference!

See real-time stamped 'action blogs' confirming and chronicling intra-day actions for each day during this EXHIBIT WEEK at www.echovectorvest.blogspot.com And review THE Complete Compilation Results provided below.

Learn the power of ProtectVEST's Methodology and Applied Market Physics.

See:

http://hstrial-protectvest.homestead.com/untitled1.html

http://hstrial-protectvest.homestead.com/services.html

___________________________________________________________________________________________________________________

GLD ETF: WEEK 7 2012 SUMMARY BELOW:

ProtectVEST by EchoVectorVEST MDPP Advanced Management Methodology Induced Results

___________________________________________________________________________________________________________________

Week 7 Beginning ProtectVEST Context:

Week 6 GLD ETF weekly closing price of $167.14, with ProtectVEST FNPosI (Insurance) and FNPosDS (Double Short) ootvs active high

price levels reset (in Friday's extended hours) at $167.55, and with ProtectVEST's last FNPosI andFNPosDS Cover Price Levels at $166.55 .

___________________________________________________________________________________________________________________

GLD ETF WEEK 7 2012 Regular Market Hours Opening Price: $167.33

13 Monday morning pre-market ootvs reset to 168.25 active since 13 Monday morning.

CGLuv = 1.70

14 Tuesday Cover both PI and DS at 167.00, and reset ub dv ootvs (both) to $167.75

CGLdv = 1.25 X3 = 3.75

15 Wednesday reset both ootvs to 168.50

CGLuv = 1.50

15 Wednesday Cover both PI and DS at 167.30, w/ initial reset of ootvs (ir) at .35.

CGLdv = 1.20 X3 = 3.60

15 Wednesday reset both ootvs to 168.

CGLuv = .70

16 Thursday 1ST Cover, PI and DS at 166.50, ir ootvs at .55 (Thursday morning)

CGLdv = 1.50 X3 = 4.50

16 Thursday reset both ootvs to 168.

CGLuv = 1.50

16 Thursday 2ND Cover, PI and DS at 167.5, ir ootvs .55

CGLdv = .50 X3 = 1.50

16 Thursday reset ootvs to 167.8

16 Thursday reset of ootvs to 168.10, taua.

17 Friday reset ootvs to 168.30 taua.

CGLuv = 1.80

17 Friday 1ST Cover at 167.50 ir .55

CGLdv = .80 X3 = 2.40

17 Friday reset both ootvs to 167.85 taua

CGLuv = .35

17 Friday 2ND cover 167.00, ir .05

CGLdv = .85 X3 = 2.55

17 Friday reset both to 167.70

CGLuv = .20

GLD ETF Regular Market Hours Closing Price, WEEK 7 2012: $167.35 -.35 from high active ootvs

setting on Friday.

Week 7 2012:

1. Passive Market Participation Results and

2. Active ProtectVEST Advanced Management Methodology Results: Comparisons:

1. Passive Market Participation Results: $59.76

GLD ETF weekly opening price: $167.33

GLD ETF weekly closing price $167.35.

*GCGL: $.02 = .00195% gain. *Gross Capital Gain Lock.

On $500,000 of employement, at $167.35 per share, the weekly *GCGL of $.02 per share gain = $59.76

2. ProtectVEST Advanced Management Methodology Induced Results: $77,830.89

GLD ETF Total GCGL for Week 7 = $26.05 points = 15.57% per share gain.

On $500,000 of employement, at $167.35 per share, the weekly GCGL of 15.57% per share gain = $77,830.89

See The Vast ProtectVEST Difference!

___________________________________________________________________________________________________________________

EchoVectorVEST Trademark Terminology References

KEV Key EchoVector

KQEV Key Quarterly EchoVector

FEV Forecast EchoVector

KFEV Key Forecast EchoVector

KQEV Key Quarterly EchoVector

QEVFEV Quarterly EchoVector Forecast EchoVector

KQEVFEV Key Quarterly EchoVector Forecast EchoVector

ST Short-Term

DV DownVector

UV UpVector

TP Target Price

PT Price Target

AP Application Price

OOTV On-Off-Through Vector

OOTVTP On--off-Through Vector Target Price

OOTVPT On- Off-Through Vector Price Target

DV OOTV AP DownVector On-Off-Through Vector Application PriceRV Resistance Vector

SV Support Vector

EXTV Extension Vector

FVParallelogramS Forecast Vector Parallelogram Vector Spread

WEVFVPSpread Weekly EchoVector Forcast Vector Parallelogram Spread

TAUA Trailing Automatic Upward Adjustment (Automatic Price Target Reset)

APR Automatic Price Reset

IR Initial OOTV Price Reset.

BWO by-way-of

CGL Capital Gain Lock

CGLuv Capital gain lock from Long Basket Positioning (upvector)

CGLdv Capital Gain Lock from Short Basket Positioning (downvector)

GCGL Gross Capital Gain Lock

Posted by EchoVectorVest at 9:17 AM

GOLD, SILVER AND OTHER PRECIOUS METALS SITE PAGE

Copyright 2011-2019. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. All Rights Reserved.